Whenever Amazon considers expanding its network of distribution centers into a new state, the company faces a trade-off: exposure to more local sales taxes, on the one hand, and lower shipping costs on the other. Over the past ten years, the company bet that the convenience and cheapness of getting products closer to customers would win out.

Now, a new study from the National Bureau of Economic Research shows the company's massive investments in building out new centers has paid off, for both the company and its customers.

Since 2006, Amazon has reduced its total shipping cost by over 50% and increased its profit margins by between 5% and 14%, according to a working paper released Monday, authored by economists Jean-François Houde, Peter Newberry, and Katja Seim. Over the same period, prices at the online retailer have fallen by almost 40%, suggesting most of those savings in shipping costs are passed on to customers, they found separately.

With these economies of density and scale, Amazon saved "between $0.17 and $0.47 for every 100 mile reduction in the distance of shipping goods worth $30," the authors wrote. The numbers were estimated by the researchers; Amazon did not respond to a request for comment.

While plenty of economists have studied the relationship between brick-and-mortar store locations and retailers' distribution networks, "little work to date has studied such classic industrial organization questions... in online markets," they wrote.

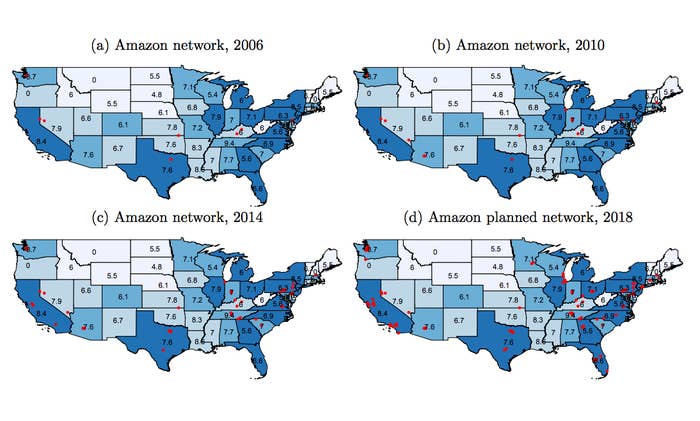

In 2006, Amazon had just eight centrally-located centers, but by the end of 2016, its network had expanded to 90. The online company now plans to expand its footprint to 100 facilities by 2018.

Amazon's warehouses, depicted here as red dots

While it has been expensive to open and operate new centers, Amazon has also been able to enter local delivery markets, "replacing traditional shippers in last-leg deliveries in large urban markets near its distribution centers," the researchers wrote.

Still, Amazon was only able to achieve its economies of scale and density "through important sunk and fixed cost investments," the authors note. "Therefore, this investment strategy is profitable only to the extent that Amazon expects to maintain

a dominant position as an online retail platform.