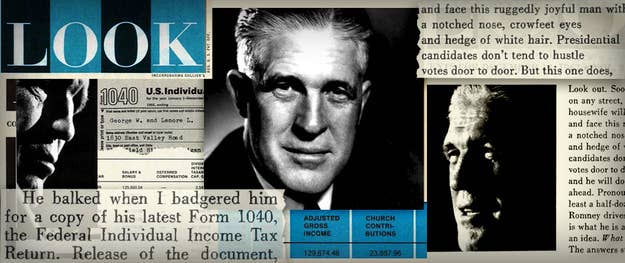

On December 12, 1967, George Romney's biographer previewed his coming book for the popular magazine Look, and offered a glimpse of what it was like to cover the almost compulsively open governor of Michigan.

Romney, T. George Harris wrote, "has a pronounced tendency to act as he sees fit, even if it might lead to embarrassment." The governor had answered a question about Mormon undergarments despite knowing that "it might inspire a national giggle," and his wife spoke with unusual openness about their marriage.

There was, though, one exception to this pattern: "He balked when I badgered him for a copy of his latest Form 1040, the Federal Individual Income Tax Return," Harris wrote. "Release of the document, while it might serve a political purpose, would not prove very much, he argued. One year could be a fluke, perhaps done for show, and what mattered in personal finance was how a man conducted himself over the long haul."

Romney's son has defined his campaign in opposition to his father's, with a strict zone of privacy that extends to his personal finances; he finally released two years of tax returns, and has refused to release more. George Romney, however, called Harris back and surprised him.

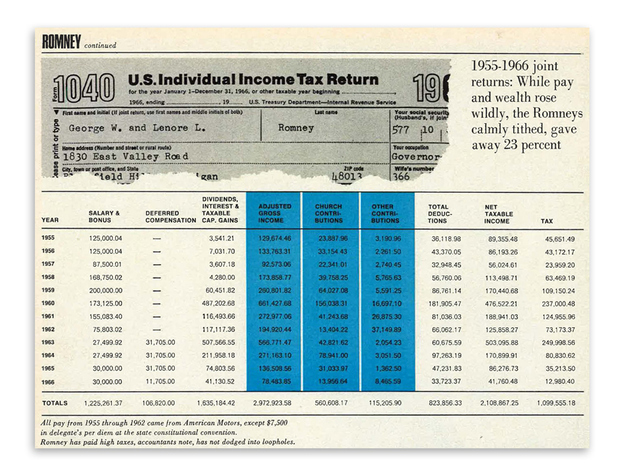

"Stumped by this argument, I was not prepared for the move that it eventually led him to make: He ordered up all the Form 1040's that he and Mrs. Rome had filed over the past twelve years — including those profitable ones from when he saved the American Motors Company from bankruptcy and became a millionaire on the company's stock options."

Harris learned a great deal from the numbers, notably that the Romneys had given 23% of their adjusted gross income to charity, about three quarters of that to the Mormon church. One year, they gave away all but $390 of Romney's salary and bonus.

Romney also payed an income tax rate several times that of his son's roughly 15%: He payed more than half of his income in taxes some years, and paid a total rate for the period over 50%.

The income statements helped Harris tell an admiring story about the governor: His stock options, they revealed, were "rising like warm dough," and by 1960 had allowed him to pay off debts.

"One question about wealth did worry Romney, from the day he saw that hte compact would make him a tidy bundle: How to use the freedom it brought.