For most millennials I know, the American dream of homeownership doesn’t just feel far away, but impossible. Especially if you live in an urban area, if your own parents didn’t own a home, if you’re saddled with student debt — it doesn’t matter if a mortgage payment might be equal to what you’re paying in rent when you’re struggling month to month, barely putting enough aside to save for an emergency, let alone a down payment.

And it doesn’t just feel like fewer of us are buying homes. Statistics bear it out: According to a 2018 report from the Urban Institute, as of 2015, the homeownership rate for millennials (then age 25 to 34) was around 37% — that’s 8 points lower than the percentage of Gen X’ers or boomers at the same point in their lives. According to the study, there are multiple, intersecting reasons for this, all of which will likely sound familiar to millennials shut out of the market: We’re getting married and having kids later; we have far more student debt; and many of us are drawn (by necessity or choice) to urban areas with “inelastic housing supplies,” where both home prices and rental costs have skyrocketed.

When I lived in Brooklyn, I’d gaze at the prices for a studio apartment in my neighborhood (between $700,000 and $1 million) or a brownstone ($2 million to $5 million) and wonder: Who could ever make this happen? Rich people, sure. But people tend to get rich, at least in part, by owning real estate. To get there, you need a down payment. And if you’re putting your extra money toward child care, or loans, or medical bills — how do you come up with that down payment? And how do you find a home you can actually afford?

Homeownership, like other forms of participation in the American dream, increasingly resembles an exclusive country club, with membership predicated on who your parents are and your race. To wit: A millennial’s likelihood of owning a home increases 9% if their own parents were also homeowners. While 39.5% of white millennials own homes, the black homeownership rate is just 13.4%, the Asian ownership rate is 27.2%, and the Hispanic ownership rate 24.6%. “Left unchecked,” the Urban Institute study declares, “current trends will result in even greater wealth disparities among white, black, and Hispanic millennials.”

Homeownership, like other forms of participation in the American dream, increasingly resembles an exclusive country club.

The trends we’re seeing right now in homeownership will reverberate for generations to come — and accentuate the 21st-century parameters of privilege. The difference between people whose family can afford to help with a down payment and people who have no choice but to rent might mean the difference between who can live within 15 minutes of their job and who has to commute two hours, between who’s employed full time and those who depend on contingent work, between who can presume safety in public spaces and whose skin color makes them a perceived threat, between who can pay for college independently and whose children — and grandchildren — will eventually take out their own massive student loans.

I wanted to talk to people within this new reality about how they actually managed to make homeownership work. So I created a survey, and asked readers and Twitter followers and friends of friends of friends: Tell me everything. Tell me how you found the house, how you pulled together the down payment, and how you feel about all of it. Being transparent about this stuff won’t necessarily make buying a home easier for others. But it will hopefully demystify what it takes to make it happen, and help make clear that millennials who don’t own homes aren’t failures. They’re just young people who have faced a dramatically different financial and real estate reality than the generations that came before — a reality that has impacted some more than others.

What follows are 14 stories chosen from over 500 submissions, and they all exemplify, in some way, themes I saw again and again. (Stories have been lightly edited for length and clarity; some names have been changed to protect people’s privacy.) Many people received money from family for a down payment; they chose to buy in an area of the country where homes are markedly cheaper; their parents were homeowners or felt very strongly about homeownership as a mark of adulthood; others are ambivalent about their own homeownership and the way it excludes so many others their age.

The shifts in homeownership aren’t just about capital and equity and down payments and mortgage debt. They’re also about how we think about ourselves, and the places we live — and about how places that remain affordable can change.

We can try to articulate new standards, different from those of our parents and grandparents, for what constitutes success or adulthood. But in this moment, we are still a country very much obsessed with homeownership — despite the fact that just over a decade ago that obsession, and the predatory lenders willing to encourage it, sparked a global financial crisis. What’s clear is that homeownership is still one of the most effective means to transmit wealth and accumulate status. Until that changes, the question of who can own a home — and how they’re able to make it happen — matters.

Daisy, Salt Lake City Area

Age: 33

Year purchased: 2018

House cost: $200,000

Down payment: $40,000

Monthly payment: $1,374

My partner and I purchased our home in Salt Lake City in March 2018. We had rented that house for 8.5 years from the homeowners before purchasing it. We had been reliable tenants, making our (low) rent payments always on time and only complaining when absolutely necessary. But once my partner and I were both settled in career-type jobs, we started looking for a house to buy. We were afraid that this low-rent dream could come to an end at any point, and that we would be priced out of the increasingly expensive housing market in SLC. Our landlords had moved out of the country and had no plans to return to Salt Lake — but we knew that our rental house had lots of issues that needed extensive repair work, so we weren't initially inclined to try to purchase it. However, we found that houses we were interested in were crazy expensive, and we really liked our location in SLC.

So we did the math — how much money would we need to put into it to make it what we would want, and how much would that allow us to purchase it for? We did an extensive inspection (which found lots of problems), had an appraisal done, and sent both the inspection report and appraisal to the homeowners with an offer of a purchase price (without using realtors, so it would save money for both parties). We purchased the home at a good price for SLC, took out a HELOC [home equity line of credit] to do the repairs, and now we're just over a year in with upgraded plumbing and electrical, a remodeled kitchen, a new two-car garage, new floors, and lots of cosmetic updates.

We were able to get the down payment from my partner's parents, and we took out a 15-year loan, because I hate the idea of paying on a house for 30 years and paying so much more interest. We're definitely a lot more tight with money now than we were when we were renting (our mortgage is double what the rent payment was), but we feel happy and secure — albeit pretty stressed out from rapid-fire home repairs over the last year.

Both of our parents are homeowners (my parents are divorced, my partner's aren't). His parents are close to paying off their home that they've lived in for many years. I'm not sure of my dad's situation, but my mom and her husband rented for years and just bought a house right before we did. I think we both did grow up thinking homeownership was important, probably me more so than my partner. I like stability, so the thought of renting for life is somewhat terrifying. I can't wait until our house is paid off and we can live mortgage-free. I would love to have a place to store my stuff or rent out that would allow me to live a bit more of a vagabond lifestyle.

Without my partner's parents' help with the down payment, I'm not sure if we would have even considered buying a house. As someone who works at a nonprofit and whose partner is a teacher, without having the connections that allowed us to buy our house at such a good price AND the help with the down payment, we would be years — if not decades — away from homeownership in SLC.

Elizabeth, Orlando

Age: 29

Year purchased: 2019

House cost: $430,000

Down payment: $86,000

Monthly payment: $1,795

I've been living in Orlando for almost three years and paying insane amounts of rent (currently renting a house for $2,400/month). I wanted to buy so that I could actually have a smaller mortgage than my rent. I live with my younger sister currently. Our mom spends some time here each year, and my dad comes on shorter trips. The idea became to pick a house that might flex enough to include space for them if they move here when my dad retires in 4–5 years. So we started looking at houses in December 2018 and just finally found one and got an offer accepted. It's crazy expensive (more expensive than my parents’ much larger house) but that’s the market here. My parents are using money they inherited from my grandparents a few years ago as the down payment. I will be on the mortgage, as will my dad (since there’s no way I would have qualified for this house). As far as covering the mortgage, it will be cheaper than our rent, although I'm paying part and my parents are covering my sister’s part since she is in college. I'm 28 and my sister is 25. Honestly I never thought I'd be able to own a house, because on my own I would probably only be able to buy a townhouse or something and not for a couple of years.

“I realized as I looked at houses how heavy the decision felt. Like, if I screwed it up I would be stuck with a house I hate for 10 years.”

I feel terrified to own a house. I really have no idea how to do a lot of things like fix things, mow a lawn, etc. I have been lucky to live in apartments where maintenance has always been available for those things. I realized as I looked at houses how heavy the decision felt. Like, if I screwed it up I would be stuck with a house I hate for 10 years (my parents don't believe in selling a house after a couple of years just to move). I couldn't decide what type of neighborhood or what area of town, and I worried about commuting constantly (a problem in a city where nearly everything is about 20 minutes away or more). I'm scared that I have too much responsibility and I have no idea how to do it.

I also feel guilty because my family's relative wealth is the only thing enabling me to buy a house. I have a bit of money saved (a couple thousand), which is more than most of my friends my age...but nowhere near enough to buy a house. I am well aware that most of my friends and peers will not be able to buy a house and definitely not one as expensive as mine any time in the near future. So I feel bad for complaining about stuff to them. I wish other people (especially older generations) would understand that I shouldn't have to feel this much guilt and fear over something that should be considered a normal step in growing up. My dad owned his first house right out of college. And his parents were definitely not rich. I wish other people would look at how hard millennials are working just to break even; moving in with their parents, delaying having kids, working three jobs, paying off mountains of student loan debt. We're doing all the things you guys told us we had to do! And the economy still sucks, and we still can't find jobs.

My dad lost a lot of money in his retirement fund in the financial crisis, so I think it has informed a lot of his decisions since then. I think that he was sold on the idea that he'd be able to nicely retire at 65 and live happily on the amount of money he had. But he's not finding that to be true, because he lost so much, plus he is still helping his kids with money. Whereas I feel like my generation is well aware we'll never retire. One of my coworkers said the other day, "I'll have to work until lunch on the day of my funeral," and we all laughed but man, is that true.

I think that everyone should have somewhere to live that is affordable and manageable. It should be an intrinsic human right. The American dream is unattainable for the younger generations. If it’s this bad for us...what will happen with the kids coming of age soon?

Amanda, Minneapolis

Age: 29

Year purchased: 2016

House cost: $180,000

Down payment: $9,000

Monthly payment: $1140

I purchased in September 2016. My strategy around my own finances was shaped by watching my older siblings graduate college and not find jobs — I picked a major based on practicality (for better or worse). I majored in economics and I got a job in operational finance ("financial analyst" was my first full-time job), knowing that such a job would likely pay me enough that I could pay off my loans. I grew up with very little money, and that drove my decisions too. I lived in an apartment by myself for three years, saving money and paying down my student debt. I was afraid to not have a cushion of savings, so instead of pushing hard on paying loans off, I balanced saving and paying down debt. I purchased my house with less than 10% down, which means I have PMI on my mortgage (which I should be able to get rid of in the near future). I think I put 5% down, all my own money. I also paid closing costs. I was able to purchase a <1,100-square-foot house that I liked for $180,000, and my salary at the time was ~$65,000.

I grew up in the largest suburb of Minneapolis. For the first 10 years of my life, I lived in the house my dad owns. My parents split up, and, for financial reasons, we had to move in with my mom's parents. We lived in their house for the rest of my childhood. I grew up assuming I would eventually own a house, and as I got older, I realized it was actually something I wanted regardless of society's expectations. Living in an apartment was an uncomfortable experience for me, because I never truly felt like the space was mine. I think being from a suburb where most people owned their homes had a big impact on my expectations. I'm sure being white has had a huge impact, one that I was never aware of growing up.

I love owning a house. It comes with its own anxieties, and I can see how it's not for everyone! I am very handy and I love doing things myself. I replaced my own gas-powered water heater! It's magical, for me, to have this space that truly feels like my own, which is something I don't know that I ever felt growing up. I can paint it and hang whatever I want on the walls. I don't have to worry about disturbing neighboring apartments (although houses on my block are close together, so I do still try to be considerate). I have outdoor space, too, including a garden and a firepit. I suppose it can be a little scary when something goes wrong, but taking care of various issues makes me feel empowered and capable.

I love my house and I am proud of myself for buying it, but I don't think that it's a good measure of much of anything *in general*.

Ellen, Dubuque, Iowa

Age: 28

Year purchased: 2018

House cost: $120,000

Down payment: $4,000

Monthly payment: $675

My husband and I purchased our first home in March 2018 in Dubuque, Iowa. We both went to college in Dubuque and have stayed ever since. We had previously lived in two apartments. The apartment we lived in was a very high price (for this area!) of $875/month, no utilities included. We were really sick of paying that much per month. We had friends that went through something called the Washington Neighborhood Revitalization Program, and they encouraged us to check it out. The city of Dubuque had been buying up decrepit properties in a lower-income portion of Dubuque called the Washington Neighborhood, renovating them and then selling them for a lower price than several other homes in Dubuque.

Also, the city offered a $10,000 interest-free loan for qualifying buyers. It worked really well for us as first-time homebuyers. In order to receive assistance from the city, we had to attend four classes that covered topics such as credit, house maintenance, and how to take out a mortgage. In October 2017, we toured a few homes that this program was working on and stumbled across our future home. They had just bought the house, so it looked honestly horrible when we first toured it. But we saw the potential and were able to put a deposit on the property. Getting in that early was great because we got a lot of say in the renovation process. So, by the time they were done with the house, they sold it to us for $120,000. We were able to get a mortgage, along with the $10,000 loan from the city. This program is so that you only pay a 3% down payment, so we ended up paying somewhere around $4,000 for our down payment. And since we had an idea of all of these costs in October, by the time that March came around we had saved that money. Our mortgage is now $675/month, which is $200 cheaper than our two-bedroom apartment! We now have a gorgeous four-bedroom home that was built in 1890 but has all-new renovations. And, even better, we can be part of a program that is helping to rehabilitate our community.

A large part of why we chose our home was the sense of community. We love Dubuque and we want to see it thrive, so being able to do our part in buying a home in a neighborhood that is often overlooked in our community was wonderful. We've tried to be involved with community events and getting to know our neighbors. There is a neighborhood garden, there are sidewalk chalk parties, deep discussions at the local brewery, and so much more. It's honestly exciting to feel our roots growing in Dubuque and getting to know so many other people that live near us.

I do feel guilty in the fact that not everyone my age will have the same opportunities that we had. Close friends of ours were house hunting at the same time as us in Chicago, and we traded stories frequently. Their house-buying journey sounded so much more stressful and cumbersome than ours. I wish that more communities would follow a similar program as Dubuque's, and offer assistance to first-time homebuyers. Programs like this could really help millennials in obtaining a home and being able to make it affordable.

Becca, Kalamazoo, Michigan

Age: 35

Year purchased: 2013

House cost: $9,200

Down payment: $9,200

Monthly payment: $350

We bought in 2013 in Kalamazoo, Michigan (I was 29). My partner and I each put down half, and we bought it in cash. We bought it off Craigslist — it was a total of $9,200, there are no missing zeros. We bought it when we were renting in Pennsylvania for ~$800/month. I graduated with my PhD and my partner was writing up his dissertation — we needed a place that was inexpensive while we looked for jobs and we wanted to move closer to my parents (about two hours away in the south suburbs of Chicago). I was very uncomfortable putting that much down because I had saved up mostly when I worked one short-term (nine-month) contract as a postdoc right after graduating. It was most of the money I had (and, of course, without a job or income we never would have qualified for a mortgage).

Obviously, these stories don't make sense to people who aren't in the Midwest. I feel like the discussion about homeownership in the media is almost completely driven by people on the coasts. People like me who bought *because* we were low-income don't fit into that narrative.

“I think the actual transmission of wealth should mostly be banned.”

My partner and I (but mostly him) put in a tremendous amount of renovation sweat equity on the house, and we did eventually take out a mortgage (for $30K) in order to manage those. We moved out in 2016 and are now renting it out for $700/month (the mortgage is $200/month; taxes and insurance run another $150 or so, so it is cash flow positive for us. If we could have found jobs in biomedical research in Kalamazoo, we would still be living there.

My parents owned a two-bedroom, suburban, townhouse-style co-op. When they died, I couldn't even sell the "share" of the co-op, so poor was the demand. I had to relinquish it back to the co-op organization. So for wealth-building purposes, they were not homeowners.

I think the actual transmission of wealth should mostly be banned, actually. We should chuck the whole mortgage interest tax deduction scam, prohibit lenders from borrowing to people in the areas that are going to be underwater due to climate change, institute an extremely large (up to 99.5%) inheritance tax on the Jeff Bezoses of the world, and support and nurture affordable cooperatively owned and financed housing. Also, we should get rid of local property taxes, ensure all schools are good, and recognize that the entire "wealth" generated through housing is just another word for profiteering off of racism.

Houses, physical houses, are depreciating assets just like cars. The *land* under them becomes valuable depending on proximity to other things. Without being in a more trendy area than other houses, they really aren't supposed to build wealth. In a better America, with excellent schools and public transportation designed in urban areas that can economically power the nation and leave us more resilient to climate change, we wouldn't be having these conversations.

Jessica, Rapidly Gentrifying Midwest City

Age: 31

Year purchased: 2018

House cost: $340,000

Down payment: $0

Monthly payment: $1,930

I’m a married, childless, 31-year-old active-duty female Army officer. I attended US Military Academy, so I have no student loan debt. My husband recently left the military, and also has no student loan debt. My husband and I bought a three-bedroom, two-bathroom, $340,000 house in a bougie, hipster-y suburb of Detroit. We used a VA home loan to buy the house, but put no money down. The VA loan has a very low percentage (3.3 %), and we mortgaged for 20 years. Our total monthly payments, plus tax and insurance, shake out to $1,930. I receive a nontaxable, zip code–adjusted stipend from the military to cover housing costs (about $2,000 per month for our area). We also own a condo in North Carolina, which we rent out to cover the mortgage ($650 a month — it’s a very cheap area). Without the military, I doubt we would have bought a home. Not having student loans or health insurance premiums and getting a housing stipend has put us squarely in the upper middle class. We are really fortunate.

I’m an immigrant. My family and I came from Mexico in the early ’90s. My parents rented until 2001, when they bought a house in an aging neighborhood. My parents separated, and after, my mother was the sole breadwinner. She nearly lost the house in 2009 when the housing bubble collapsed. Our housing situation was extremely unstable when I was growing up. I learned that owning a home is a stronger assurance against possible homelessness than simply renting. I also increasingly came to see it as a mark of financial stability.

We associate stability with homeownership, but that also implies that we are supposed to stay in one place. I think millennials will probably be more mobile as we age, chasing job opportunities where they may be available.

Dave, Boston Suburbs

Age: 34

Year purchased: 2015

House cost: $465,000

Down payment: $55,000

Monthly payment: $2,365

I've always wanted to own a home. My grandfather built his own house in the ’40s and lived there until the day he died. Both my parents were free spirit types who could never stay in one place; they moved around constantly, falling in and out of love with apartments, houses, and relationships. I'd never lived in one place longer than three years until I bought my home.

When I got engaged, our first and easiest decision was to forgo a wedding and focus on saving for a house. It was a huge challenge: We moved to the suburbs to save on rent. I worked hard to get a new, higher-paying job. We never went on vacation. But saving was still difficult. There was always something: car repairs, surgery, and other emergencies.

My uncle died by suicide in the fall of 2013. My dad knew how badly we wanted a home so he decided to give us his inheritance from my uncle's estate, about $50K. We had $10K in our own home savings, which we'd use for closing and moving costs. We had trouble finding a mortgage lender who would work with us; even though we had the cash and our credit scores are mid-700s, they frown on applicants whose down payments come from gifts. Through a friend, we finally found someone.

We live in Boston. The property market here is a monster: Houses and condos are expensive and inventory is extremely low. The city and surrounding suburbs generally only allow high-end development. One strategy that was common during our search in the fall of 2014 was to put a property on the market on Thursday at a suspiciously low price to attract as many people as possible to the open houses on Saturday and Sunday, with final offers due on Monday, and the house sold on Tuesday. We fell for this a few times; in one case we offered $476,000, the list price, for a home, only to find out we were one of 20 offers, and the house sold for $560,000.

We first saw our home at an open house at the beginning of Boston's notorious winter of 2015. It was listed at $505,000. We went to a second showing with our realtor, who encouraged us to be aggressive because no one up here sells in the middle of winter unless they have to. We offered $450,000, they countered at $475,000, and we eventually settled on $465,000. We got a foot of snow on our moving day.

I originally felt that homeownership made me "more" of an adult than marriage did. That was my reason for not wanting a wedding; buying a home is much more of an achievement than signing a piece of paper, I would say. I don't feel like that anymore. Buying a home is a responsibility and, in my case, a gift.

I feel incredibly self-conscious about my homeownership. In my circle of friends, we're one of two couples that are homeowners. The others would like to own but are stuck renting. Most of them know that I was given my down payment, and it makes me feel guilty. I want to help them out, but I can't afford to — my payment is still more than most of them pay in rent. I don't know what to do about my friends that face structural barriers, like a friend who has a six-digit down payment to buy but needs an accessible building with nearby subway access, and there simply isn't anything like that in our market under $1 million.

Jay, Midwest College Town

Age: 30

Year purchased: 2014

House Cost: $146,000

Down Payment: $7,300

Monthly Payment: $1,000

I bought my house in 2014 when I was 26. I live in a small college town in the Midwest and had just got a staff job with a university. I love HGTV and home improvement shows so much and I was so excited at the prospect of owning a home and making it my own. I had been living in Chicago in a 300-square-foot studio paying $850 a month. When I got the job and started looking at homes, I priced out my monthly payment and saw that I could get a home with 3 beds/1.5 baths and end up paying around $1,000 a month after putting down the minimum 5% down payment. The market in town was a really welcoming one, and I found a lovely little ranch-style that had recently been flipped. My family was very supportive of me buying rather than continuing to rent. Also, there's a big market in town for weekend rentals for football games. I knew that if I needed to, I could rent out for games for additional income (I have yet to do this, but friends in town in a similar situation do regularly).

My grandpa and aunt both gifted me money to make a down payment and help with initial move-in costs and more. I would not have had the savings to make my down payment without that gift. I'm incredibly thankful for that gift, but recognize the incredible privilege in being gifted it. I don't know anyone in their twenties who has the savings for a down payment without family help. I certainly feel guilty at having a home at this age and certainly at having financial support from family to do it.

All the initial excitement at owning a home faded when I started signing papers and actually moving in. I was single and I work in media, and I saw my friends struggling to make it in major cities. Sharing pictures of my house and its yard felt really lame. I felt like I was "skipping steps," like I should have been married or older or more established. I made a real effort to try and share my home as much as possible with friends as they passed through town for football games, letting them stay for the weekends, cooking for them, because it felt really indulgent to have all the space to myself. Being only 26 when I first moved in, I'd host someone who had just graduated college and they'd just go wide-eyed at the place. I'm proud of the place, but thinking that people are comparing to my circumstances made me feel shitty. I try to be really transparent with friends about how I was able to do this. If they ask, I tell them what I bought for, how I had support, what it takes to afford it, etc. I want them to know that it's 1) not totally impossible to become a homeowner, 2) only possible thanks to where I live and my family's initial gift, and 3) that it does feel great to have the responsibility and pride of owning your own place.

“I feel like I sometimes skipped the line in regards to class in this country.”

I come from an immigrant family and grew up in a diaspora community. My dad worked 41 years at a paper manufacturing plant, my mom was a schoolteacher. They always owned their home, but it wouldn't have been possible for them without support from family. My folks received a gift/loan from my great-aunt and -uncle to buy their home. They raised us with this info, telling us how much this aunt and uncle loved us and wanted to help, that they owe so much to these family members. It was a good reminder for me when I felt guilty at being helped by family when I bought my house — that my parents had to be helped and that I come from a family that really wants to help each other. I feel like I sometimes skipped the line in regards to class in this country. My parents struggled to make ends meet, but there was always outside help to boost us up — whether that was homeownership or new clothes or even vacations. I went to a good school, have a good-paying job, have more upward mobility than my immigrant parents, but I wouldn't be where I'm at by any means without family support. I'd like to build my own image as a fully self-made man, but it's just not possible or rational.

I live in a neighborhood where I have a vested interest in improving. I live alongside people who I need to care about. It's made me much more responsible and engaged with my wider community. I had none of that as a renter. I lived in my building for two years in Chicago and never bothered to meet a soul there. It's made me consider where I live in a fuller way, and I think my generation needs more of that — I don't think it's unrelated that I've become more engaged politically since becoming a homeowner. I need my community to thrive and I need to be a part of that work.

I should also say, it changed my romantic life as well. Buying as a single guy made me feel really out of sorts — you're supposed to buy a house when you're married or starting a family, right? Bringing someone back to my home felt very different from dating before that. There was sometimes concern or fear — what would they think? Would they be impressed? Maybe too impressed? Would I be a catch or maybe a mark? I've found myself dating guys who are also homeowners. We can share a love for home improvement (I'm a stereotype, I know), but it also feels like I'm with someone in a similar stage of life. Certainly as a gay man I imagine some fabulous home with a partner as a status symbol, an assertion that my gayness is valid and good and even enviable. I try to check myself with that privilege and don't let it become a barrier to meeting someone, but it certainly is a thought.

The thought would run through my head when I first bought — "Oh, I'm now a land-owning white man, if this were a different era I'd be able to vote" — and yeah, that's a very stupid and gross thought. But certainly, there is status in homeownership. I've seen how people take me more seriously when I tell them I own. Certainly, I take pride in what I have and the work I put in to keep it, but it's only by the grace and privilege of having a family support me that I was able to do it at all. I didn't don't this all by myself and in reality I'm still a small emergency away from having to run back for help. I think it makes sense that homeownership serves as a symbol for success in America — sure, you could make it on your own, but in reality you need all the right circumstances and support from previous generations to have a chance.

Jennifer, South Orange County, California

Age: 35

Year purchased: 2016

House cost: $860,000

Down payment: $210,000

Monthly payment: $3,800

My dad is a real estate agent. He gave us his commission from the home purchase to add to the down payment. We borrowed the money from my in-laws and then paid them back when the commission came through. On top of that, my in-laws gave us a gift to add to the down payment. The house was a rundown condo, but my dad called in a bunch of favors to put sweat equity into it. We also put about $2,000 of savings into updating the kitchen before we sold it. The house was a short sale, and when we sold it we made about $140,000 on the sale. We put that toward the second house. When we sold the second one, we made about $270,000. Our third and final house is worth close to $1 million. We have about $400,000 worth of equity in it. I can't believe how easy it was to accrue this wealth.

I definitely notice my privilege when I recount how easy it was to accumulate wealth. Our parents were knowledgeable and had the cash to loan and gift us. I forgot to mention that we lived with them before we bought our first and second houses to save money for the biggest portion of the down payment. I know we were privileged to have parents with homes large enough to fit us.

I think real estate is an easy way to accumulate wealth, but it's only available to a small amount of people. I think about our quick and easy wealth accumulation all the time. I can see the clear relationship between having wealthy parents and easily having wealth ourselves. It's so obvious. And, yeah, we "work hard," but definitely not harder than the next guy.

Allyson, New York City

Age: 35

Year purchased: 2013

Apartment cost: $560,000

Down payment: $235,000

Monthly payment: $2,600

I purchased a one-bedroom apartment with the help of my parents in 2013 when I was 29. I never expected to be in a position to own in New York. I work for a nonprofit and, at the time, I was making $55K/year. I had more or less come to terms with the fact that I wouldn't be able to do the work I do and stay in NY long-term. Then I found out a colleague had been trying to sell her apartment unsuccessfully for a year. I mentioned it to my parents, thinking it would be an investment opportunity for them and they surprised me by saying it was something they would help me do.

It was a really scary decision. The commitment to a mortgage was overwhelming and I was worried about being indebted to my parents and how that would play out. It felt very weird to have this golden ticket when a lot of my friends were struggling to make their rent. It seemed horribly unfair. I was embarrassed by it, honestly. At the time, I sat down with one of my closest friends and told her the situation. I said I was thinking it was too much and that I shouldn't do it. She looked at me without judgment and said, "You're a fucking idiot if you don't take advantage of this." So I swallowed my anxiety and guilt and went for it.

In the end, my parents gave me some money for the down payment and loaned me some more so I could put close to 40% down so that the mortgage was manageable. The deal is that I pay them a little bit toward the loan each month and I will pay the rest back whenever I sell my place. After I moved in, I spent $5,000 putting up walls to make the apartment a two-bedroom so I could get a roommate. That was the only way I could afford to live there. I lived with a roommate until my now-husband moved in. The biggest shock of homeownership to me was the constant cost. Within the first six months the radiator broke, which was $800. Then the washer/dryer broke, which was another $3,000 and a few PTO days to oversee installation. Then it was the AC for another $500, then the dishwasher was another $900. I was hemorrhaging money. Plus the HOA fees keep creeping up. I pay $300 more in monthly HOA fees than I did when I first bought it, mostly because property taxes keep rising.

Sarah, Western New York State

Age: 37

Year purchased: 2015

House cost: $80,000

Down payment: $10,000

Monthly payment: $300

I purchased my first home in my hometown in Western New York in 2015. It is a row house/duplex. There are several of them around town, built in the 1800s for workers at a local shoe factory (since demolished). My sister and I purchased the home together since she was recently separated from her husband and had a 12-year-old daughter, and I was recently widowed and had two children, ages 2 and 4. We split the down payment, we split the mortgage, we split the dinners and the childcare. We were like co-wives. Sister parents.

I came up with my half for the down payment by using money that was left over from a GoFundMe account that was started to help cover my husband’s medical bills, funeral expenses, and our travel/hotel stays while he was hospitalized for cancer treatment. He died after only three months of treatment, so we had some left over. I was also able to file as a widow on my taxes, so I still got his tax return, which was sizable because the year that he died followed the year that I was off for a few months on maternity leave. I’m a waitress so we were pretty poor. The down payment was about $10,000 (my half) and the house was around $80,000. It needed (still needs) a lot of work.

After three years of living there, I had met someone new and had another baby and acquired a dog. We had to buy a bigger house. The widow exemption tax thing lasts for three filing seasons, if I remember correctly, so I just sat on that money after paying down credit cards and the like. My boyfriend saved what he had been paying in rent for two years and when it came time to buy our house we had a decent down payment. I now co-own two houses. I’m renting the old house to my best friend, who actually owns her own home, which she rents out. (Incidentally, she was able to buy her house because of a workers’ compensation settlement due to an injury waiting tables. She now has income from that place.)

“An untimely cancer death, the generosity of friends, and tax returns from a dead man all made homeownership possible for me.”

So an untimely cancer death, the generosity of friends, and tax returns from a dead man all made homeownership possible for me. My husband and I couldn’t even have afforded to buy that place together if he had lived. We’d never have had $10,000 cash, or the credit needed, due to debt-to-income ratio. I was a waitress so on paper I only made like $6,000 a year some years. I always wanted to own a home but was never sure how we could make it happen.

I’m white, grew up in the 1980s, poor/middle class. My parents fell in love with the home the week before their wedding in 1979 and bought it the day before they got married. They held their reception there. It was $49,000. My mom worked a few jobs at a time; my father’s parents provided care for us after school. The neighborhood I grew up in was mostly apartments (big old houses chopped up into smaller units, rundown, and not well cared for).

Our city is pretty poor, so I guess I just took for granted that I would always live approximate to poverty, if not IN poverty. When my boyfriend and I bought our new house at the more “suburban” end of town, it took a while to sink in. I still laugh at the fact that I live somewhere without sidewalks and with a lamppost outside. From a widow on food stamps (I was on food stamps before widowhood) to owning a four-bedroom ranch is HILARIOUSLY unreal to me.

I’m not sure what I wish other people knew about it except that it’s hard to achieve homeownership, it’s a lot of work, and once you have a house you’re kind of married to it. You have to take care of it ALL the time! It’s how you spend your downtime, like mowing lawns and painting walls. But it’s an investment for my children, above all else. Giving them a secure, safe, stable place to grow up and equity when we die is important enough to sacrifice weekend brunches and going to the movies, I guess.

People don’t really think about how having grown up in a home that their parents owned set them up for success in a lot of ways. Their parents had something to borrow against. Their parents couldn’t be evicted, etc. So many people who grew up just over the poverty line don’t realize how much homeownership largely played a role in their economic survival. I think it’s unfortunate just how much opportunity is dependent on owning property. I struggle with the idea of being a landlord — it costs me $300 a month to own that house. But now I charge just about triple that to a poor person who can’t get a home loan! She pays 3x more a month to have nothing.

Emily, Lexington, Kentucky

Age: 37

Year purchased: 2014

House cost: $102,000

Down payment: $5,000

Monthly payment: $765

I decided to buy a home after renting a broken-down duplex for seven years. My upstairs neighbor smoked pot constantly, and it wafted down into my apartment so much that it made me sick. I didn't have any money for a down payment, no savings, and shit credit, but I had to move. I worked with a fantastic realtor who walked me through every step of the process. I ended up having to borrow my down payment, so I essentially have two mortgages. My mortgages combined are just a little more than I was paying in rent, but my utilities are lower because it's a newer house, so it more or less works out. I have my mortgage automatically deducted from my bank account, and it's scheduled for the day after payday.

I've gotten pretty good at moving money around to cover expenses. I took out a loan from my retirement to pay for a new roof and other minor repairs. I had to have several large trees removed, so I put that expense ($1,800) on my credit card, then took out a second loan from my retirement to pay off that and the first loan. It worked out to be better terms over a shorter period. As Lin-Manuel Miranda says, chess, not checkers. You have to think about how one financial decision will affect everything else.

“As a renter, I would wake up to the sound of rain, and think, ‘That's a lovely sound.’ Now I wake to the sound of rain and think, ‘Shit, I have to clean the gutters.’”

I was terrified when my realtor told me the seller accepted my offer. What the hell did I know about homeownership? Should the furnace be making that sound? What should a furnace sound like? If I need to repair my back fence, how do I go about checking property lines? I'm still not sure what equity is. There's not a day that goes by that I don't do a walk-through looking for things that need repair. It completely changes how you think of money and finances. When I get a tax refund or some money from a freelance gig, I always think about what the house needs before I let myself think about paying other debt or planning a trip. As a renter, I would wake up to the sound of rain, and think, "That's a lovely sound." Now I wake to the sound of rain and think, "Shit, I have to clean the gutters."

But on the flip side, I'm proud of what I accomplished on my own. I have a former friend who thinks that homeownership is oppressive. She thinks that because I'm not free to suddenly pursue a work opportunity across the country, or that I think about things like siding repair or water heaters, means that I'm being crushed under this burden of my own making. I don't think homeownership is the pinnacle of "adulting." It's not for everyone, and not everyone can do it where they live. I just happen to live in an area (central Kentucky) where it's actually cheaper to own a home than it is to rent.

Anne, Large Pacific Northwest City

Age: 36

Year purchased: 2015

House cost: $440,000

Down payment: $40,000

Monthly payment: $2,700

My husband and I bought a house almost four years ago in a large Pacific Northwest city. It's small and weird and, like, we're basically only having one kid because of the space, but it was what we could get for the cost we wanted to spend ($400K–$450K) in the city. At the time, I worked at a university in an admin position making $50K, and my partner worked as a developer making more than twice that. We were/are very privileged and lucky and squirreled away roughly 10% (~$40K) for a down payment. Neither of us got help from our parents outright, BUT neither of us had student or medical debt. In my case, this was because my parents paid for undergrad. So we got indirect help?

OH GOD MY PARENTS ARE SUCH HOMEOWNERS. They're very white and very Lutheran and I was raised in not-so-white and not-so-Lutheran Southern California. Growing up, my mom told me several times that Lutherans have the highest ownership rate of any religious group in the United States. She didn't say that Lutherans are also mostly white people in the Upper Midwest. They may not have explicitly equated owning with morality, but there was a lot of talk growing up about other people's frivolous spending and how we Just Weren't Like That and that's why we were safe financially and other people were not. Renting just wasn't seen as an option. They're now retired and are considering moving to a new city in California. When I suggested that they rent for a year to see if they like their new town before committing to buying a home there, they looked at me like I had two heads. It's the same with a lot of things millennials share — tool libraries, cars, Netflix passwords, whatever. They just want one of each thing for themselves.

I recognize that I'm an outlier as a millennial. Our city’s home prices have gone up so much in the last five years that we'd be paying almost twice as much for a similar house now. But the thing is, our house is nothing like the houses I grew up in, or beautifully renovated the way I see on Instagram. It's half the size of the house I grew up in.

I've spent a lot of time trying to unlearn the idea of success that my parents taught me, and trying to understand the transmission of wealth. Growing up, my parents referred to themselves as "middle class," didn't have debt other than a mortgage, and paid for three kids to go to college debt-free. That's more than middle class, at least in California. They also taught me to be financially independent, but I know now that that's also a lie. Even though they didn't directly help me out with my home purchase, their wealth still made it possible. I was able to save up money for a down payment because of that wealth. I was able to save some extra money after college by living at home, and be picky about taking a job with good insurance because I could wait for it. I was able to make a lot of the decisions that I've been able to make in my very privileged life because I didn't have medical or student or credit card debt.

Juli, Austin, Texas

Age: 35

Year purchased: 2013

House cost: $240,000

Down payment: $35,000

Monthly payment: $1,600

My husband and I (white people) bought a fixer-upper (more of a teardown, but we didn't know it at the time) in Austin, Texas, in August 2013. At the time we were 29/30 years old. House was listed at $220K, and after a bid-out with another couple, we purchased for $240K. My husband and I are both journalists; he had a regular full-time gig at a nonprofit making about $38K/year, and I pulled in around $50K/year freelancing. Thanks to living frugally, neither of us having student loans (our upper-middle-class parents paid for our pricey private educations), and not having/not wanting to have kids and thus no related expenses, we had about $15K in savings. We combined that with about $10K from each of our sets of parents. Our mortgage comes out to about $1,600/month for a 900-square-foot rat trap on a huge lot in walkable, tree-lined, verve-tastic Central Austin. It is my absolute dream home and I will die on this land.

My parents are homeowners — in fact, my dad is a custom homes builder. They have been married for nearly 50 years, and moved to the Dallas–Fort Worth area in the ’60s to bootstrap themselves out of the poverty/abuse they experienced growing up in Deep East Texas. They are smart and resourceful people who nevertheless hold some deeply shitty, deeply classist, and racist views about poverty, homeownership, education, etc. My mom in particular has a strong aversion to people who live in mobile/manufactured/trailer homes (this is "redneck") despite (because of?) having lived in a trailer home with my father until she was in her mid-twenties. Now, as custom homes builders/small business owners (a career/business my dad pursued after building a cushion as a pharmaceutical accountant), my parents have what seems to me to be bougier-than-usual taste in homes and home design. For example, they own a vacation/lake home in East Texas with an open-plan, 200-square-foot kitchen that they repeatedly describe as "too small for two people." It's sort of amazing to me that I'm supposedly the entitled millennial, but two people who grew up in houses with literal dirt floors and no indoor plumbing now feel like a sprawling kitchen does not meet their needs.

I feel surprised about homeownership. I did not expect to become a homeowner before my parents died (I assumed I'd buy a house with my inheritance someday), and it is wild to me that I happened to have saved up one-third of a down payment on a home in a very expensive market as a freelance journalist before I was 30. (It's even wilder to me that after talking to our mortgage people, they would still have approved our loan even on my husband's salary alone, just with a shittier rate, which, like, in the year 2013 how are those places still being like, “Ooh, definitely give a $240K loan to a man making $38K a year, great idea”?????)

Obviously our ability to put a good amount in as a down payment was only possible because of our parents' wealth, and I feel weird about that but not so weird about it that I wanted to continue renting. Because my husband and I bought in a pretty central location, our house is significantly older/less fancy/smaller than the homes of our fellow millennial home-owning friends who either just plain have more money than us or who bought in less central areas, and I'm a little proud of our shitty rat trap, actually. Somehow it makes me feel less bad about having had to rely on our parents for part of the down payment. (Even though I don't know any millennials who bought a house without money from their parents.)

This is an economic barometer that doesn't bug me much, even though it probably should. I think homes hold stories, and I think passing homes and those associated stories down in families is a beautiful thing. I also think we're a nation of white settler colonizers who entirely fail to grapple with what that means historically and currently, so fuck homeownership anyway. I don't know. Everything is the worst. ●

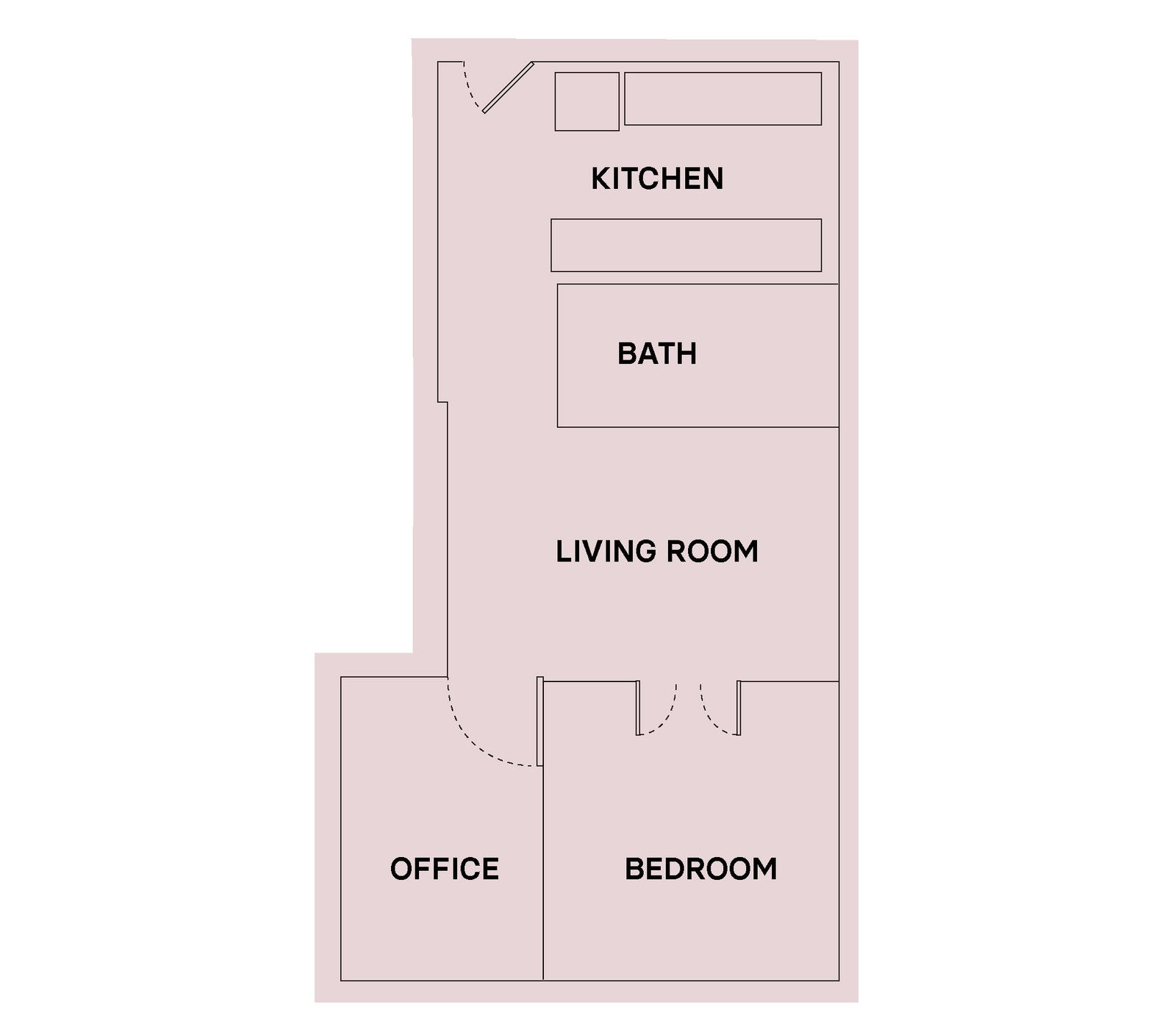

Illustrations by Ben Kothe / BuzzFeed News